What is No-Cost EMI?

In simple words, no-cost EMI is a financing scheme offered by merchants and retailers by which you pay the price of the product in equated monthly installments without any interest or extra cost.

How does it work?

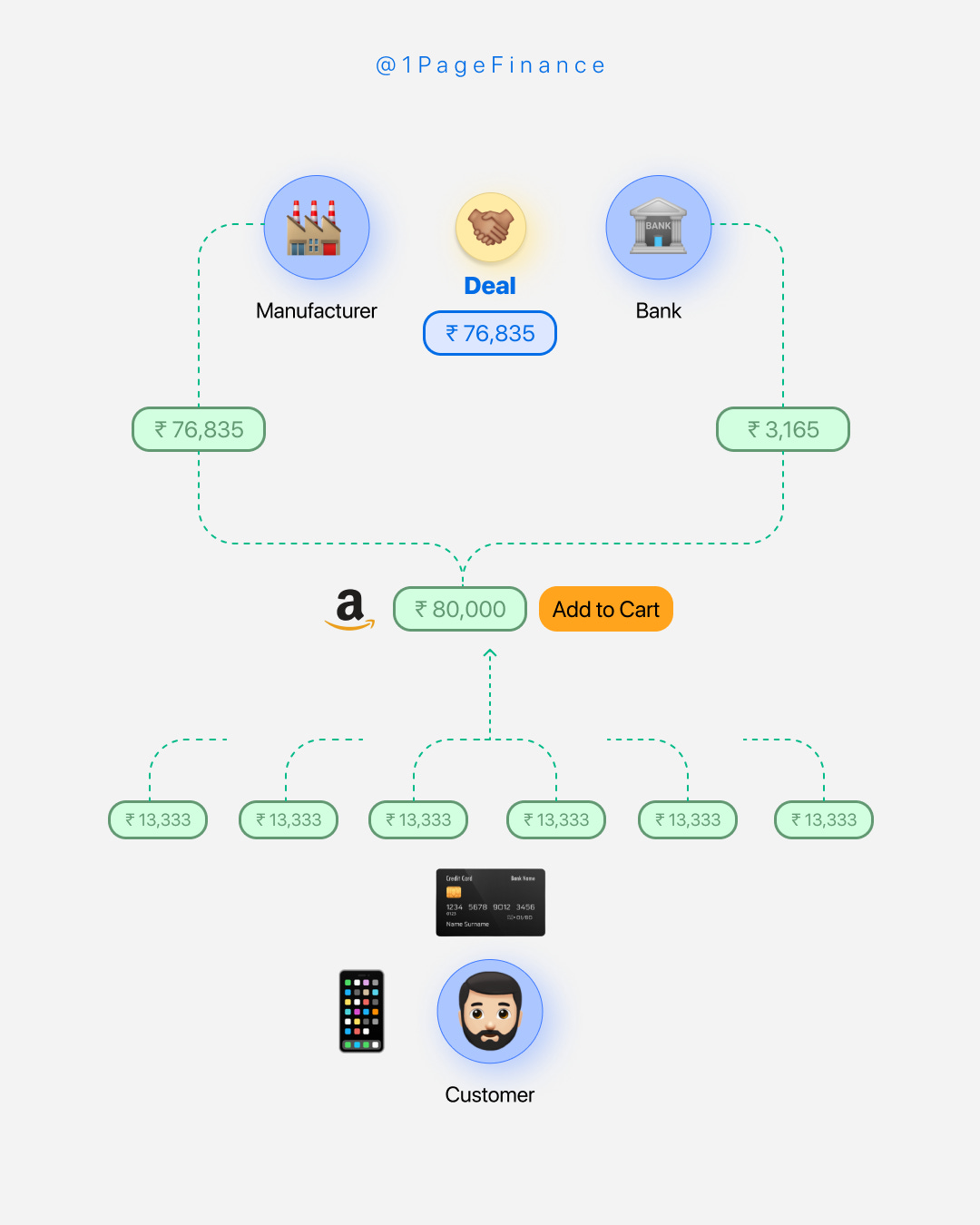

Generally, there are three parties involved in the transaction, the retailer/ manufacturer, bank, and the consumer. One thing we need to understand that neither manufacturer nor bank are charitable organizations. They are in the business to make profits. In the case of no-cost EMI, the manufacturer offers a discount that is equivalent to the interest cost (but not to the customer).

Let us see how no-cost EMI works. The iPhone 12 is available for sale on E-comm website at ₹ 80,000. If the customer opts for the EMI option with the tenure of 6 months using the Credit Card, the customer will have to pay a monthly installment of ₹13,333. The total amount paid by the customer is ₹ 13,333 x 6 months, which equals ₹ 80,000. However, the customer will have to pay GST on the interest amount charged by the bank.

In certain cases, banks also ask for 1 advance EMI from the customers. In this case, the interest earned by the banks would be even higher. Table below shows the magic of cashflow.

Things to consider before opting for No-Cost EMI

In certain cases, the lender may also charge transaction fees, processing charges, etc. Carefully read all the terms and conditions before you opt for the no-cost EMI option.

Not all the products may be available under a no-cost EMI offer. Sometimes outdated products are offered under this scheme to increase the sale. However, manufacturers who are willing to push the sales of their new products may also be available under the no-cost EMI option, like, iPhone products.

No-cost EMI option is available for selected tenure only (Generally, not more than 6 months).

In case you miss any EMI, the lender may charge penalties for late payment, which may go up to 48% of the principal outstanding. In addition, it may also hamper your credit ratings.

Some of the offline retailers add back the actual interest cost to the price of the products, thereby making the price of the product much costlier.

Beware! No-cost EMI is a marketing gimmick adopted by the retailer/manufacturer to lure customers. You might end up buying the product you don't need.

💡 Nothing comes free of cost in life. No-cost EMI would be a better option for you if you are short of cash and the product that you are willing to buy is under the scheme. Do evaluate all the possible options and inquire about the terms and conditions associated with it, before jumping to conclusions.