🚨 Emergency Fund: The First Aid For Your Financial Stress

A first step towards prudent financial planning.

Covid-19 has highlighted the importance of keeping a pile of emergency funds. This 1 page will provide important information you need to know about emergency fund.

🤔 What is an Emergency Fund?

An emergency fund is the money kept aside in liquid form to be used only in the event of emergencies and financial crisis. It is one of the foremost steps of personal finance.

💁🏻♀️ Why to maintain?

You’ll have less financial stress during difficult situations. It prevents you from unnecessary borrowings and tapping into your investments in an emergency.

🤷🏻♀️ How much to maintain?

Ideally, you should keep aside at least 6 months of expenses as an emergency fund. A larger emergency fund (9 to 12 months) is advisable if your income is variable or uncertain.

🏗️ How to build?

Set aside a comfortable amount from your salary each month. Use part of bonuses and tax refunds to strengthen your emergency fund. One should consider building an emergency fund before entering into a volatile stock market.

Starting early is the key to setting up an emergency fund because it helps you build up a comfortable cushion against unexpected emergencies later in life.

🧐 Where to invest?

An emergency fund should be liquid and easily accessible to any non-financial savvy member of the family. There are various options like cash, savings account, sweep-in-facility and liquid mutual funds. Select based on your comfort and ease of access.

🚨 When to use?

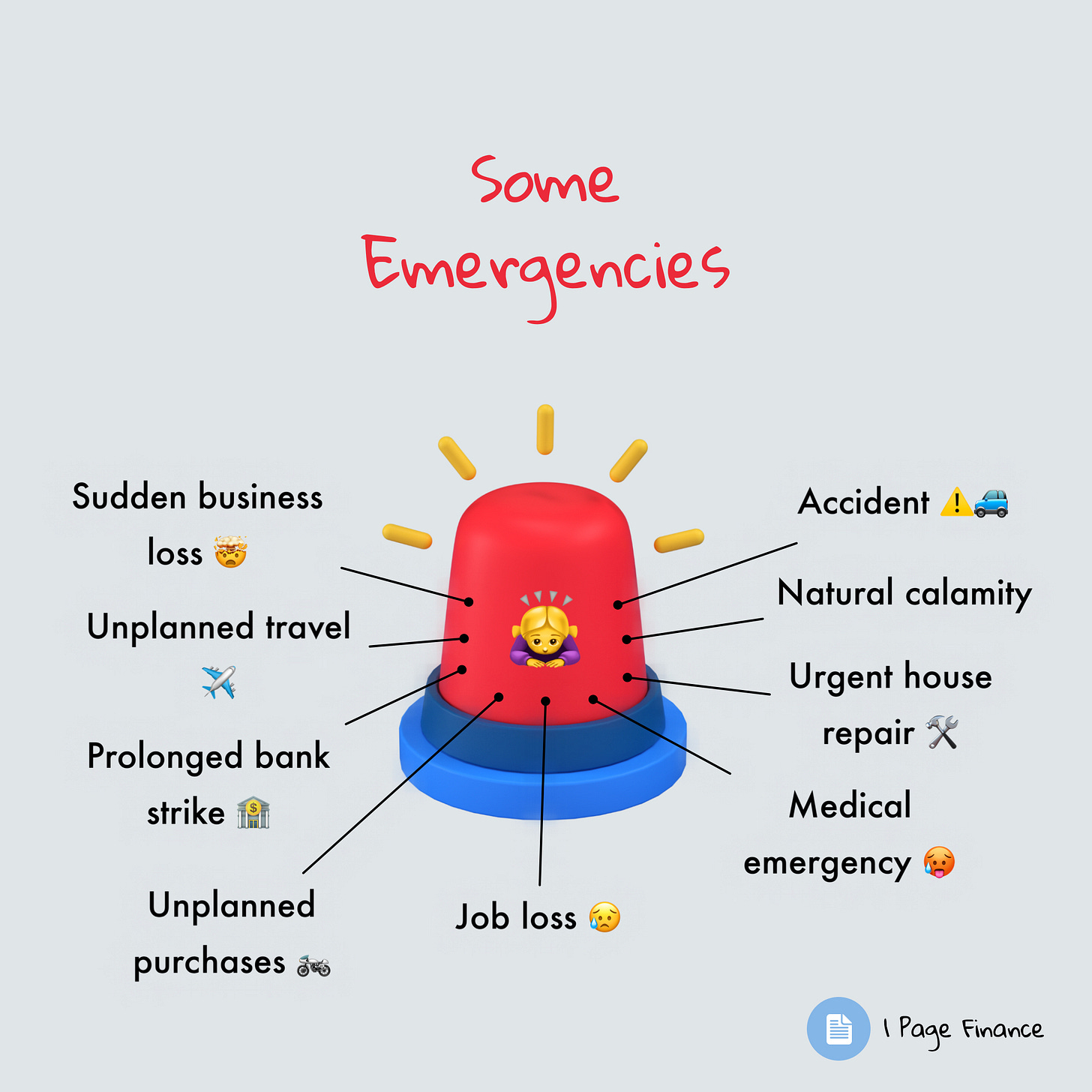

The definition of emergency may differ from person to person. Few examples are Job loss, medical emergency if a cashless facility is unavailable, unexpected home/car repairs & unexpected travel. The best way to decide is to ask questions to yourself, Whether the expense is unexpected? Is it necessary? Is it urgent?

💡 There may be temptation to use your fund for incidental purposes, so be sure not to empty this resource for any other reason other than an actual emergency.